Alternatively, you can schedule a fixed amount to be transferred into your Clink account on a monthly or daily basis.Ĭlink investors currently pay no fees, nor do they need a minimum deposit. By linking your credit card and bank account to the app, you can invest a percentage of recreational purchases. If you’d rather shop than save, Clink may be the best investment app for you. Best investment app for overspenders: Clink

Although kids may not care, Stockpile users can’t see company balance sheets or portfolio performance projections.Ĩ. And if you buy the gift card with a credit or debit card, expect to pay an additional 3%.

Gift cards, however, cost $2.99 for the first stock and $0.99 after that. Although this investing app makes sense for parents who want to pique their kids’ interest in investing, beware its fee structure.įor a standard trade, Stockpile charges $0.99. Best investment app for parents: Stockpileįounded by a CEO who wanted to give his nieces and nephews something more substantial than toys for the holidays, Stockpile lets investors buy blue-chip stocks and ETFs via gift cards. And if that’s not enough, they can stop into one of TD Ameritrade’s 364 branch locations.ħ. If they need help, they get 24/7 phone, text, and instant messaging support. Traders can choose between stocks, bonds, ETFs, mutual funds, futures, foreign currencies, ADRs, and more.

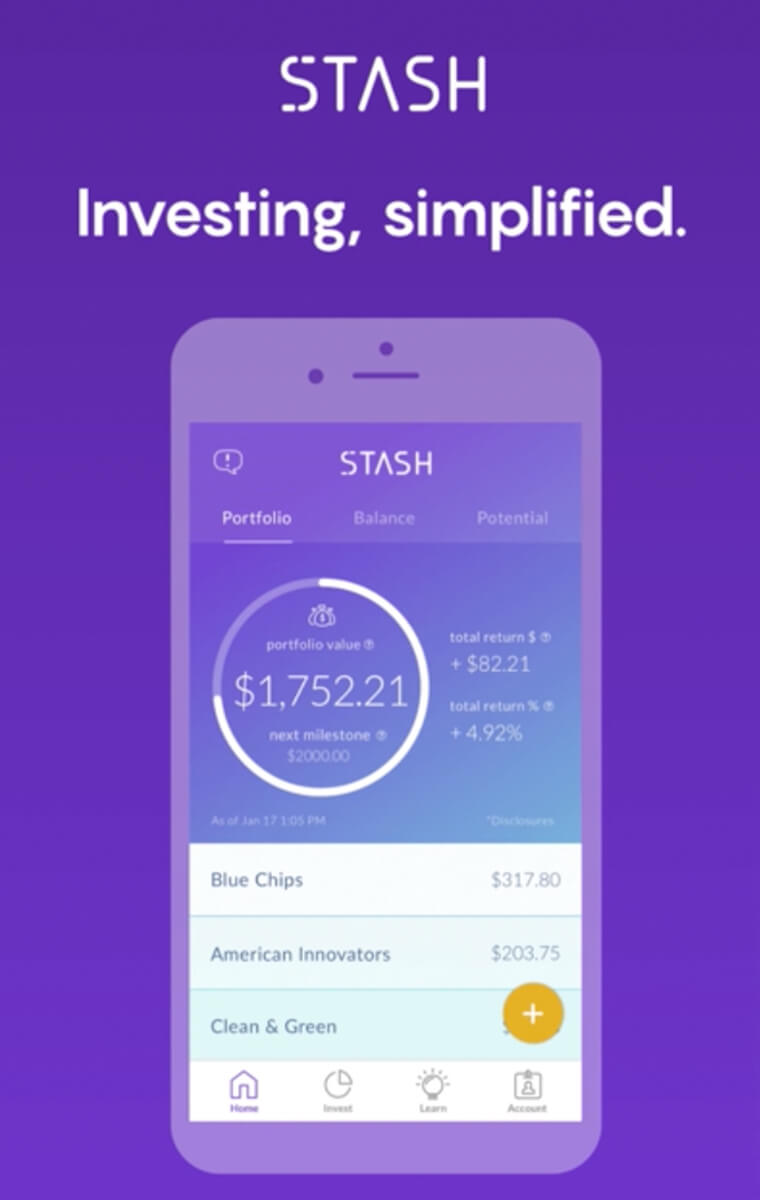

Why would users pay TD Ameritrade’s fees? Because its asset options and customer support are second to none. Options cost even more, with a $0.75-per-contract upcharge. It does, however, charge a comparatively expensive $6.95 per trade. Best investment app for customer support: TD AmeritradeĪnother brokerage competing in the investing app space, TD Ameritrade doesn’t require a minimum investment. To make their holdings more obvious to beginners, Stash renames ETFs with monikers, such as “Clean & Green” for the iShares Global Clean Energy ETF.Ħ. Unfortunately, though, Stash only offers about 150 stocks and 60 ETF options. Stash requires just $5 to open an account, and users can purchase fractional shares in stocks and ETFs. At the $9-per-month level, they also receive two custodial accounts, monthly investment research, a stronger rewards structure, and an upgraded debit card. Where Stash stands out is its account options: For a flat $3 monthly fee, users get brokerage, bank, and retirement accounts. Like Acorns, Stash is one of the best investing apps for beginners. Best investment app for banking features: Stash Due to its educational tools and array of assets, this investing app is a smart pick at the poles: Beginning investors will appreciate the help building a risk-aligned portfolio, while veterans will like its professional-grade investment options.ĥ. In exchange for that data, E*Trade does charge steeper commissions, at $6.95 per trade, than many providers on this list. Users of the investing app can dig deep into earnings, dividends, company news, and metrics like debt-to-equity ratio. There, E*Trade provides interactive charts and expert studies. E*Trade’s stocks, mutual funds, ETFs, futures, and options are backed by its best-in-class research library. Through the Power E*Trade app, do-it-yourself investors can buy into a wide range of assets. Best investment app for data dissectors: E*Trade For $1, $2, or $3 per month - depending on the user’s account balance - Acorns offers a passive portfolio of ETFs.Ĥ. The difference between the balance due and the next dollar is then invested in the user’s Acorns account.īut be warned: Acorns’ flat fees can be stiff for those with smaller account balances. Unlike most investing apps, it also offers a “spare change” savings tool, which rounds up purchases users make at select retailers.

#STASH INVESTING FREE#

To cater to the fledgling demographic, Acorns provides free management for college students. Best investment app for student investors: AcornsĮvery investor has to start somewhere. It’s relatively bare-bones for an investing app, but it’s the best way to trade individually for free.ģ. Robinhood doesn’t offer any retirement accounts or managed portfolios, meaning all investments made through the app are taxable and self-managed. Unfortunately, Robinhood users do make some sacrifices. With no commissions and a $0 account minimum, Robinhood cuts out most of the costs typically associated with investing apps. Best investment app for minimizing fees: Robinhoodįor investors who want to do it themselves and pay as few fees as possible, Robinhood is one of the best investment apps.

0 kommentar(er)

0 kommentar(er)